best canadian stocks to sell covered calls

To have a Canadian covered call ETF in the list the best one is ZWB BMO Covered Call Canadian Banks ETF for consistency and safety. It is an American pharmaceutical company.

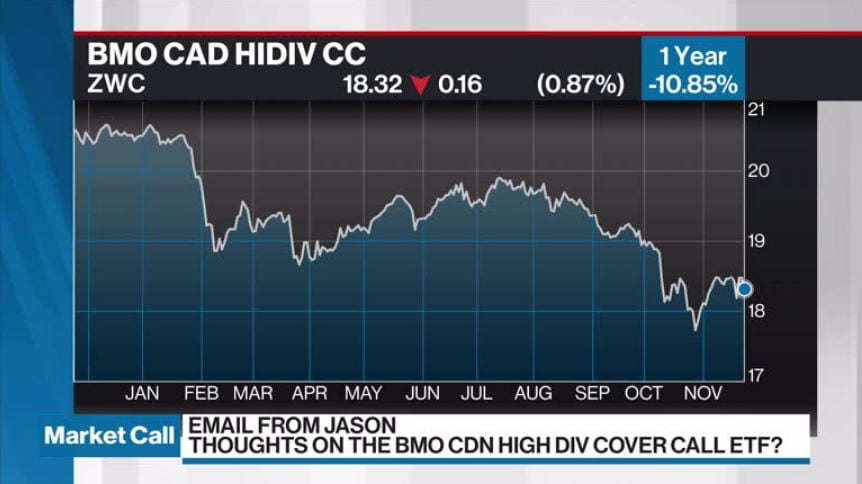

Mike Philbrick Discusses Bmo Canadian High Dividend Covered Call Etf Video Bnn

One positive of the declining stock price is a very tasty pardon the pun dividend yield which currently sits at 432.

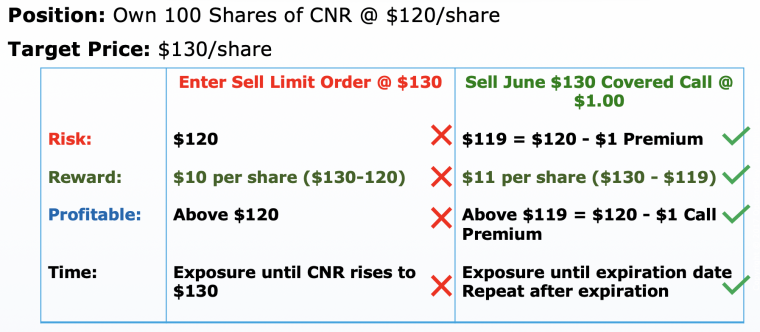

. Selling a covered call means writing a call option against shares of a stock that you own. Using a covered call trade strategy during a bull market will underperform stocks but they will still realize profits. Many top the high RSI overbought lists after seeing multi-year lows during the pandemic.

List of Best Stocks for Covered Calls in 2022. Selling call options helps produce a flow of income yielding anywhere from 5 to 13 per cent which beats the typical blue-chip income stock or. Exxon Mobil XOM 4.

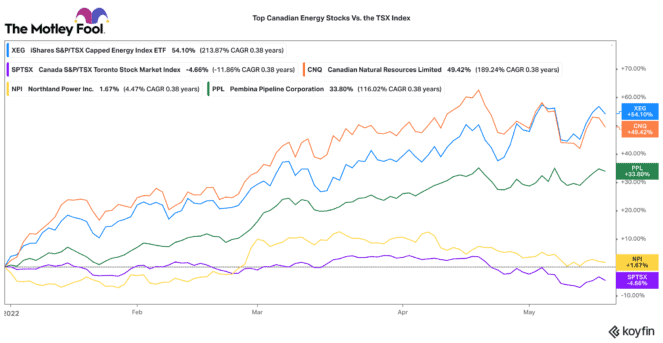

But you should be aware that dividends do play a role in call option pricing. Oil gas and energy companies are some of the best-performing stocks over the past few months with some at our near all-time highs. Make Monthly Income Selling Covered Calls Canadian Passive Income Youtube 3 Covered Call Etfs That Yield Between 10 12.

Is this not a good deal. For example OXY was a 10 stock in Summer 2020 and a 28 stock to start 2022. For example lets say that the XYZ Zipper Company paid a 050share dividend on June 1.

If some gets called away at 105 its been a heckuva run. So with that said could anyone recommend some good stocks to sell covered calls on. In Canada some top dividend stocks include.

Or is this too good to be true. I would assume that this is because most Mid-Large cap Canadian stocks are slow and steady dividend payers and not as many high growth stocks. KHC KraftHeinz Dividend Growth Stock Chart.

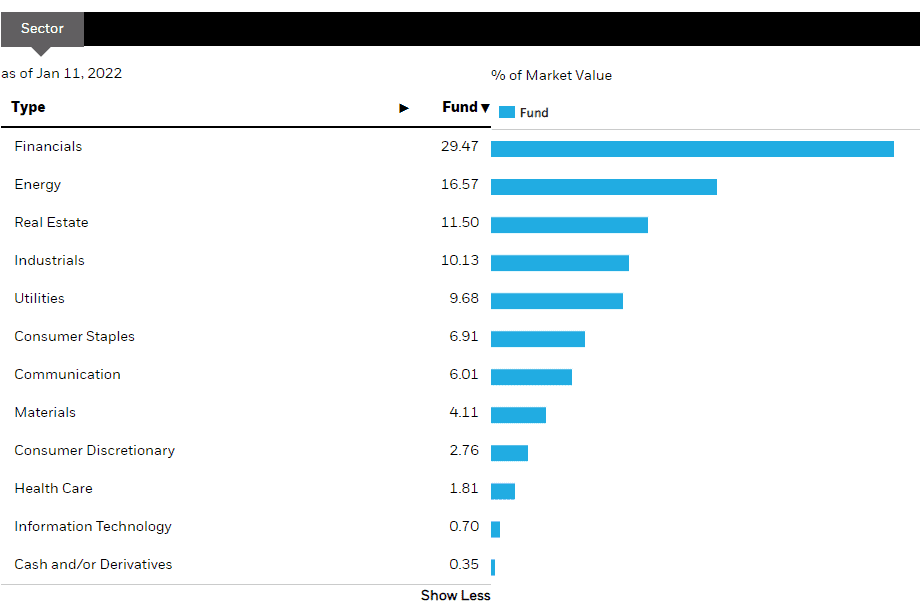

This ETF is more of a value play than it is a growth strategy since most of the underlying. The 105 January calls are trading over 2 so selling against 13 of a position would get. Devon Energy is valued at 3955 billion on the stock market and the companys price is now trading at 5955 per share.

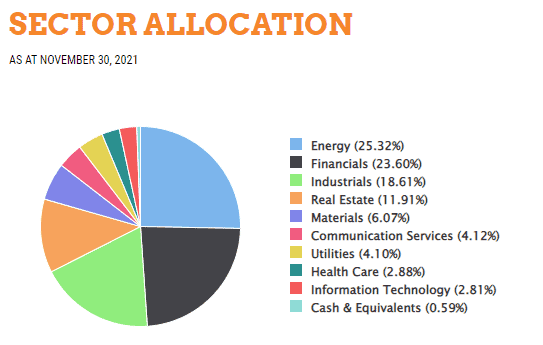

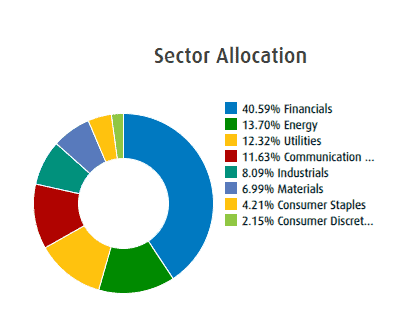

Best Covered Call Stocks In 2022 ConocoPhillips NYSE. The pink with 173 is NA National Bank the Purple and light blue is TD and BMO with around 120 return and the blue colour at the bottom with 36 is ZWB the BMO Covered Call Canadian Banks ETF. Best Canadian Stocks For Covered Calls Nbdb 9 Best Covered Call Etfs In Canada Simplify A Complex Strategy.

Below we have compiled a list of best stocks for covered call. It is now 70. If risk of a downturn is high trim some of the stock position outright at.

SHOP is too expensive for me to buy 100 of them so any stock under 50 would be ideal. - How about NOK. Covered Calls and Stocks.

The BMO Europe High Dividend Covered Call ETF TSXZWE is another great way to collect dividend income. Polaris Infrastructure KevelPitch Check back here for the most up. Check out the best NFT stocks to buy now.

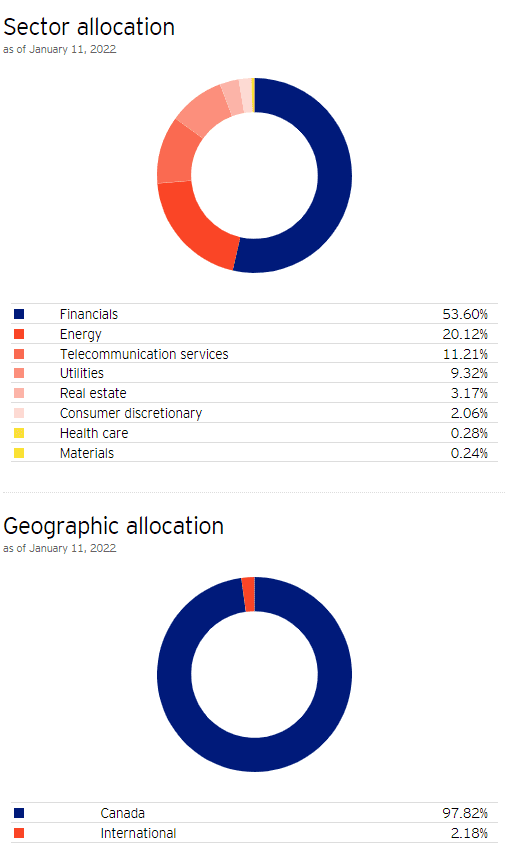

It will give investors exposure to all of the 6 major Canadian banks including the likes of Royal Bank TD Bank and even National Bank. The company was established in 1886. The Canadian covered call bank ETF by BMO serves a simple purpose.

What are some good picks for covered calls these days. What are some good picks for covered calls these days. Lets have a closer look at one of the more popular Covered Call ETFs in Canada ZWB which has been around since 2011.

In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because that money is no longer owned or controlled by the company. COP ConocoPhillips engages in the exploration production transport and marketing of crude oil bitumen natural gas natural gas liquids as well as dissolved gas on a worldwide basis. The 10 best stocks for a covered call are as follows.

Current price is 403 and all unlikely strike prices from 400 down to 050 pay up to 350stock. But with the added covered call strategy the yield increases to 939 more than double the original yield. The pink with 173 is NA National Bank the Purple and light blue is TD and BMO with around 120 return and the blue colour at the bottom with 36 is ZWB the BMO Covered Call Canadian Banks ETF.

Johnson Johnson JNJ JNJ Quotes by TradingView. Morgan Stanley MS 5. Investors looking to boost the income on this stock could sell a covered call using the October 19 th 60 calls which can be sold for 220share.

Always take into account that the premium is worth the risk you are taking on the covered call trade. According to CNN Money experts anticipated a 12-month price goal of up to 70 a minimum of 60 and a median price target of 5954. For example ZEB offers a current yield of 429 not bad at all for a basket of Canadian banks.

This combination has the same risk profile as selling a naked put. Procter Gamble Pembina Pipeline Brookfield Infrastructure Partners Fortis Inc. The ETF will then sell covered call options on those stocks to generate income for its unit holders.

This can be a whopping difference. Best stocks for selling covered calls tend to be the ones that stay relatively neutral. Always think that the premium is worth the threat you are taking on the covered call profession.

When selling covered calls I generally recommend selling on 13 to 23 of you position. Best stocks for selling covered calls tend to be the ones that stay relatively neutral. FHI CI Health Care Giant Cover Call ETF The ETF holds the top healthcare stocks from the US which have usually less volatility than other sectors and many pay a decent yield to add to the income from the options premium.

Alternative Income Strategies May Be One Of The Best Ways To Navigate The Current Market Bnn Bloomberg

Top Canadian Dividend Etfs Why We Don T Own Them Tawcan

Dogs Of The Tsx A Simple Beat The Tsx Strategy

![]()

Best Covered Call Etfs Supercharge Your Income

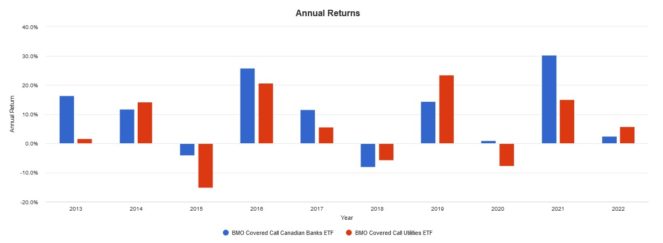

Zwb Vs Zwu Which Covered Call Etf Is The Better Buy For Canadian Investors The Motley Fool Canada

The Definitive And Practical Guide To Selling Covered Calls Option Matters

Zwb Vs Zwu Which Covered Call Etf Is The Better Buy For Canadian Investors The Motley Fool Canada

Writing Covered Call Options And Additional Income Nbdb

Dividend Investors 3 Of The Best Canadian Etfs To Buy For 2022

Top Canadian Dividend Etfs Why We Don T Own Them Tawcan

3 Canadian Energy Stocks To Buy For Reliable Passive Income The Motley Fool Canada

Top Canadian Dividend Etfs Why We Don T Own Them Tawcan

Top Canadian Dividend Etfs Why We Don T Own Them Tawcan

Now Get Your Cash For Structured Settlements Though An Ease Process Contact Us Today We Will Help You To Encompass A Certain Things To Sell Annuity Cash Now

Canadian Covered Call Etfs R Canadianinvestor

Covered Call Etfs Here S Why New Investors Should Avoid Them

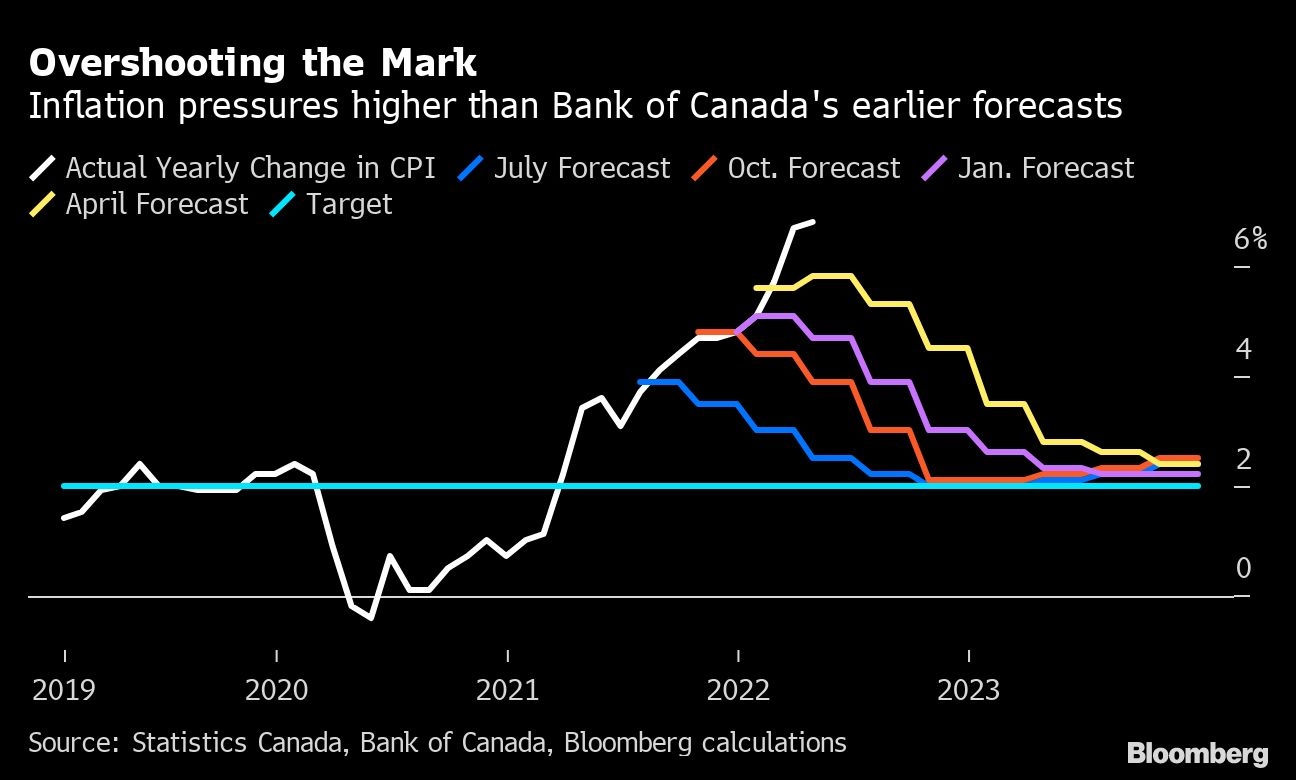

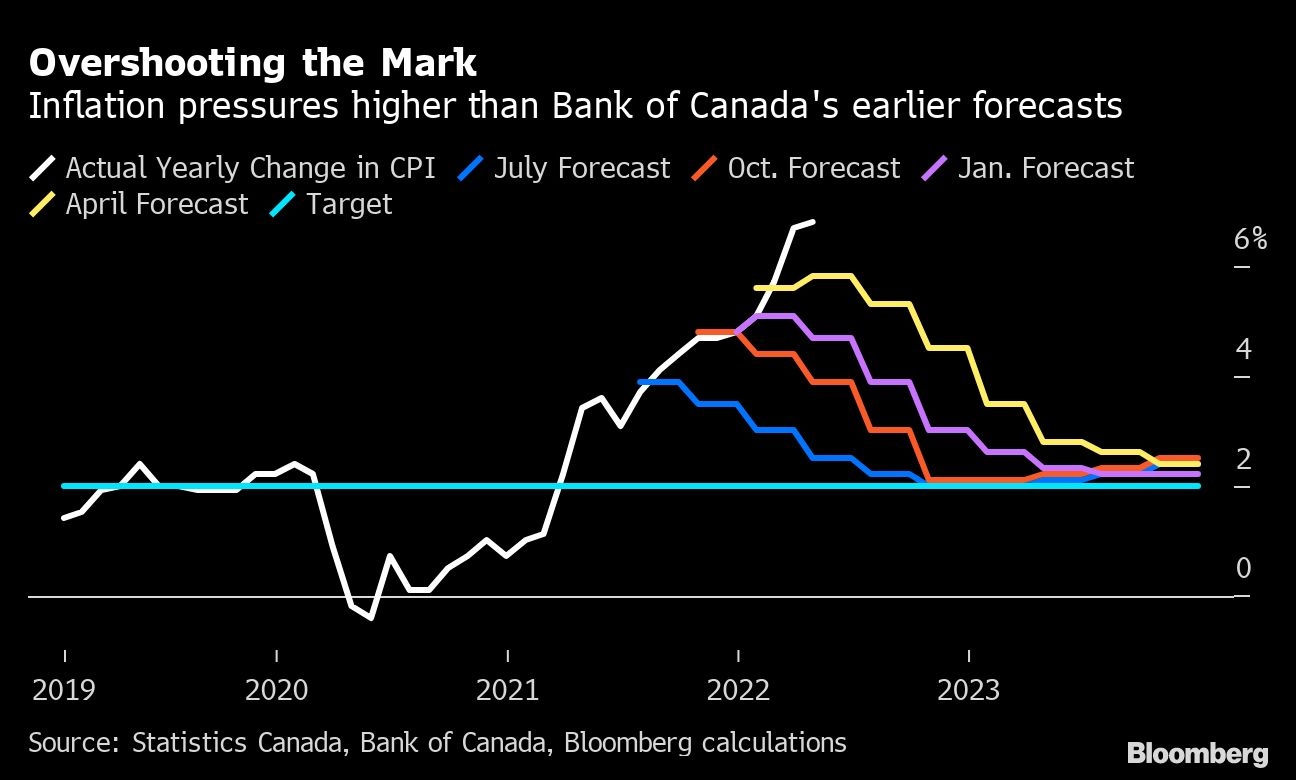

Bank Of Canada Set To Deliver Another Jumbo Rate Hike Bnn Bloomberg